A Federal Tax ID Number, also commonly known as an EIN (Employer Identification Number) or a TIN (Taxpayer Identification Number), is an identification number given to your business in order so the IRS is able to identify your business to federal agencies.

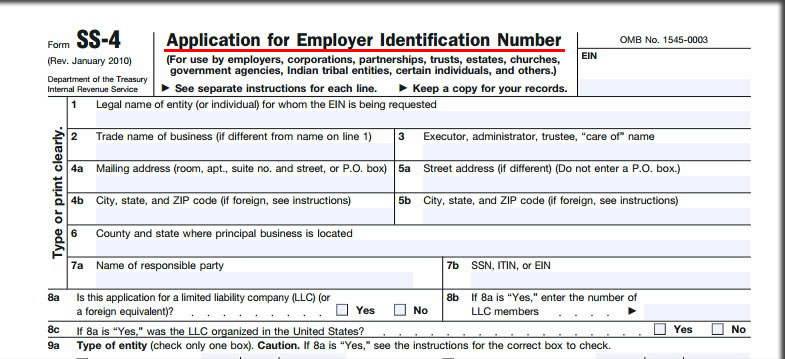

The Federal Tax Identification Number is also known as the Employer Identification Number (EIN) is a nine-digit number given to you by the Internal Revenue Service (IRS) to identify tax accounts of employers and certain other who do not have any employees. To apply for an EIN or Tax ID number, you must have a Social Security number or an Individual Taxpayer Identification Number (ITIN). The IRS issues ITIN's to individuals who are required to have a U.S. Taxpayer Identification Number but do not have a SSN, and are not eligible to obtain a SSN.

All legal businesses need a Federal Tax ID or EIN to operate, the criteria are as follows: do you have an employee(s)? do you operate as a corporation or partnership? do you file tax returns for the following: employment, excise or Alcohol, Tobacco and Firearms? purchased an on going business?

All other entities not mentioned above are required by law to obtain an EIN.

All banks will require your company to provide an EIN to open a bank account in the US; your company would also be required to obtain an EIN if you will have wage-earning employees in the US.

If you form a business entity (corporation or LLC) or partnership, which is technically a separate “person” from you (even if you are the sole owner and the only worker), then you must get a tax ID number for that business.